Table of Contents

ToggleTL;DR

This comprehensive guide to mortgage rates in New Zealand is your one-stop pillar resource for understanding how rates are set, choosing between fixed or floating rates in 2024, reviewing expert forecasts, and comparing current offers. If you’re researching “mortgage rates NZ” or “current mortgage rates NZ,” this post is optimized to meet your needs and answer your questions with accuracy, trust, and insight.

What Is OCR and How Does It Affect Your Mortgage?

The Official Cash Rate (OCR), set by the Reserve Bank of New Zealand (RBNZ), is the main tool used to control inflation. When the OCR goes up, banks typically raise mortgage interest rates, and when it drops, the reverse happens. Why? Higher OCR means it’s more expensive for banks to borrow money, which leads to higher rates for you. OCR decisions are influenced by inflation, employment levels, and global economic trends. As of early 2024, the OCR has been held steady in response to easing inflationary pressure, but remains relatively high compared to pre-COVID years.

Current Mortgage Rates in NZ

What Happens When Your Fixed Rate Expires?

When your fixed term ends, your mortgage usually reverts to your bank’s standard floating rate — unless you choose to refix or restructure. Options include:

Refix: Choose a new fixed term (rates may differ)

Restructure: Adjust loan type, split fixed/floating

Refinance: Switch to another bank for better terms Tip: Start shopping 60–90 days before expiry. Banks may offer retention deals.

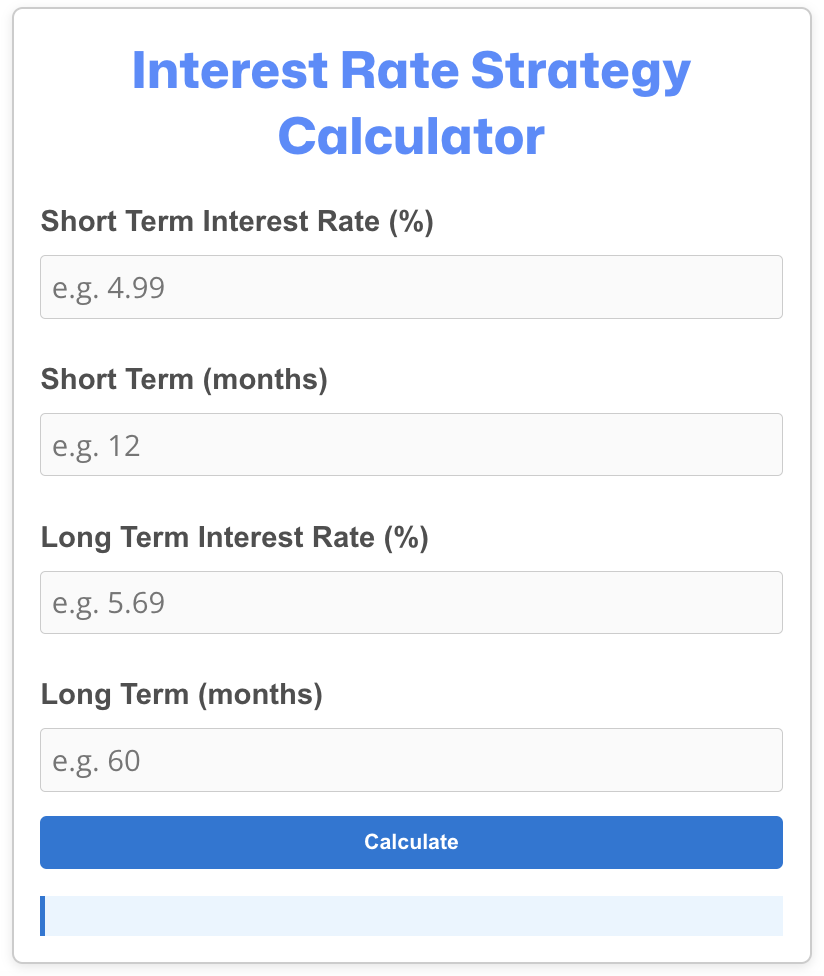

What Rate should I fix at? (Calculator)

Cashback Offers

If you’re considering refinancing your mortgage in New Zealand, cashback offers can provide a valuable financial incentive. Many banks across NZ currently offer cashback deals of around 0.9% of your lending amount when you switch lenders. This can mean thousands of dollars back in your pocket, making it a smart strategy for homeowners looking to reduce costs or restructure their loan.

For example, a mortgage of $500,000 could qualify for a cashback of up to $4,500, depending on the lender’s policy and your eligibility. Generally, the higher your loan amount, the larger the cashback you can expect. Cashback home loan offers have become an industry standard, particularly among major banks competing for new clients. These incentives are especially accessible if your mortgage is currently on a floating rate, as this makes it easier to move without incurring break fees. It’s often worth testing the waters to see what other lenders might offer in return for your business.

Even if your mortgage isn’t entirely on a floating rate, there are still options available. If you’ve been with your current bank for over three years, they may offer you a retention cashback to encourage you to stay, particularly if you’re considering moving your loan elsewhere. However, if you’re still within the first three years of a fixed-term mortgage, cashback offers may come with strings attached. Most lenders include a clawback clause, meaning if you leave the bank or refinance within a set period (usually three years), you’ll have to repay the cashback in full or in part. This can negate the benefits of switching, so it’s essential to calculate your total costs carefully.

For those in fixed-term mortgage agreements, it’s also important to consider break fees before refinancing. Breaking a fixed-term loan early can lead to substantial fees, which may outweigh the value of any cashback offer. We’re currently developing a break fee calculator tailored for NZ homeowners, and we’ll link to it here once it’s available. This tool will help you make an informed decision about whether refinancing makes financial sense in your situation.

To make the most of mortgage cashback opportunities, it’s highly recommended to speak with a mortgage broker. A broker can help you compare cashback mortgage deals, assess potential break fees, and navigate clawback conditions. With the right advice, refinancing your home loan in NZ could be a smart move — and a rewarding one.

| Mortgage Balance | Cashback Offer (0.9%) |

|---|---|

| $0 – $100,000 | $0 – $900 |

| $100,001 – $200,000 | $900 – $1,800 |

| $200,001 – $300,000 | $1,800 – $2,700 |

| $300,001 – $400,000 | $2,700 – $3,600 |

| $400,001 – $500,000 | $3,600 – $4,500 |

| $500,001 – $600,000 | $4,500 – $5,400 |

| $600,001 – $700,000 | $5,400 – $6,300 |

| $700,001 – $800,000 | $6,300 – $7,200 |

| $800,001 – $900,000 | $7,200 – $8,100 |

| $900,001 – $1,000,000 | $8,100 – $9,000 |

Conclusion: What Should You Do Now?

Navigating mortgage rates requires a proactive and informed approach. With rates fluctuating and banks competing through cashback offers and flexible loan structures, staying engaged with your mortgage options is more important than ever.

To make smart decisions, start by comparing your current mortgage rate against the latest market offers. If your rate is significantly higher, refinancing — especially with cashback incentives — could unlock substantial savings. However, always weigh potential break fees and clawback clauses before making a move.

Above all, seek professional advice. Consulting a mortgage broker can streamline your decision-making, helping you navigate complex options and find the best deals tailored to your financial goals.

Your mortgage is likely one of your biggest expenses — making the right moves now could save you thousands in the years ahead. Stay informed, plan ahead, and take action to ensure your home loan continues to work for you, not against you.

Frequently Asked Questions

What is the OCR and how does it impact mortgage rates in NZ?

The Official Cash Rate (OCR), set by the Reserve Bank of New Zealand, directly influences mortgage rates. When OCR rises, borrowing costs increase, and mortgage rates generally go up. When OCR falls, banks often reduce mortgage rates.

What happens when my fixed mortgage rate expires?

Once your fixed rate expires, your mortgage typically reverts to the lender’s floating rate unless you refix or refinance. You can:

Refix: Lock in a new fixed rate for certainty.

Restructure: Split your loan between fixed and floating.

Refinance: Switch lenders for potentially better rates or cashback offers.

It’s smart to explore options 60–90 days before expiry to avoid being locked into less competitive floating rates.

How do cashback offers work when refinancing in NZ?

Cashback offers are incentives from lenders to attract borrowers. Typically, NZ banks offer about 0.9% of your mortgage balance as cashback.

However, they often come with clawback clauses—meaning if you refinance or close the loan within a certain period (usually three years), you may have to repay the cashback. Always calculate total savings, including any potential break fees.

Is breaking a fixed-rate mortgage worth it to refinance?

Breaking a fixed term early can incur break fees, which may offset the benefits of refinancing. Use break fee calculators (or consult your broker) to compare potential cashback savings with break fees. If break fees are too high, it may be better to wait until the end of your term.

How do I choose the best fixed rate to lock in?

Choosing the right rate depends on:

Current market rates vs forecasted trends.

Your financial stability and risk appetite.

Length of the fixed term (1-year vs 5-year rates).

Use our mortgage rate calculator and consult a broker to model different scenarios based on your personal situation.